|

|||||||

Welcome to the Horizon Software Home Page. We provide a variety of products and services, including 1099-series magnetic media software, pari-mutuel racing products, and custom software development/consulting services. |

||

2025 FireTax is here!The latest version of our 1099-series tax software, FireTax, has been updated for 2025. FireTax is still the easist way to get your forms entered, printed, and submitted quickly and accurately.

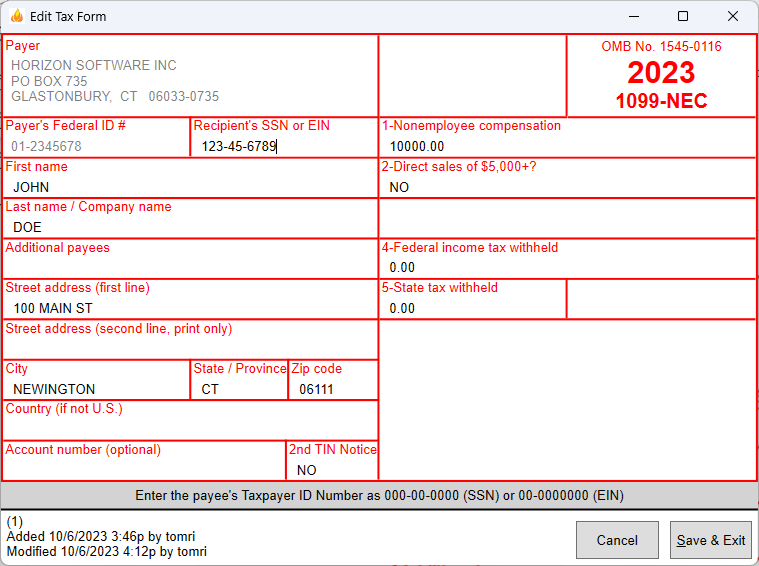

Includes Form 1099-NEC When reporting nonemployee compensation you must now use Form 1099-NEC. In previous years, nonemployee compensation was reported on Form 1099-MISC in box 7, but starting with the 2020 tax year you must report NEC in box 1 of 1099-NEC instead. |

|

|

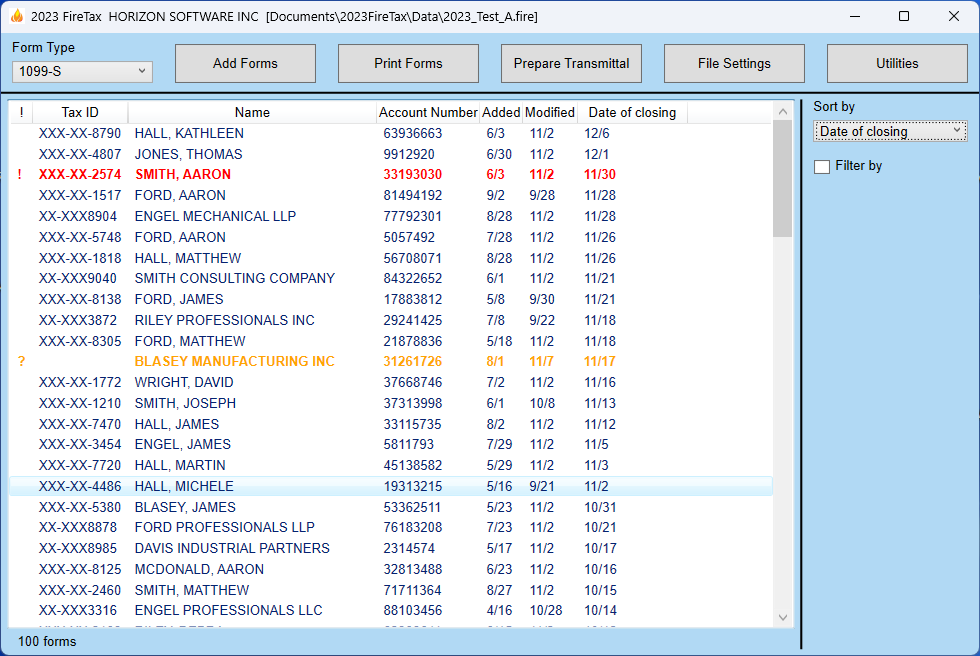

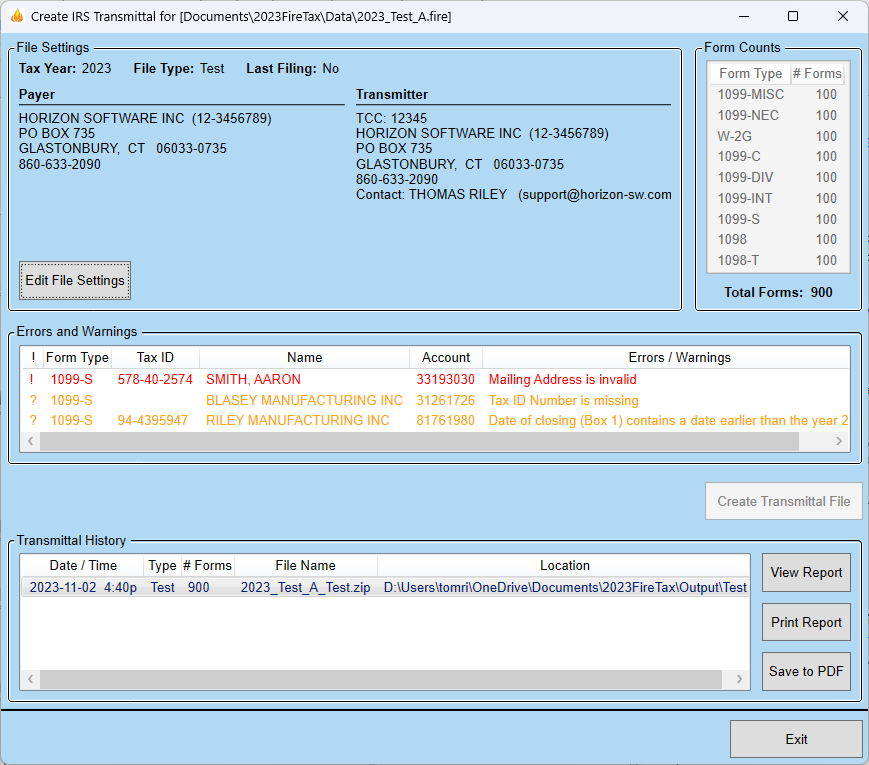

Color-coded Errors & Warnings If a form has an issue that might indicate trouble, such as a missing Tax ID number, but the format is still acceptable to IRS, the form will be highlighted in ORANGE in the main menu. Critical errors, that would prevent a form from being accepted by IRS are highlighted in RED. |

|

|

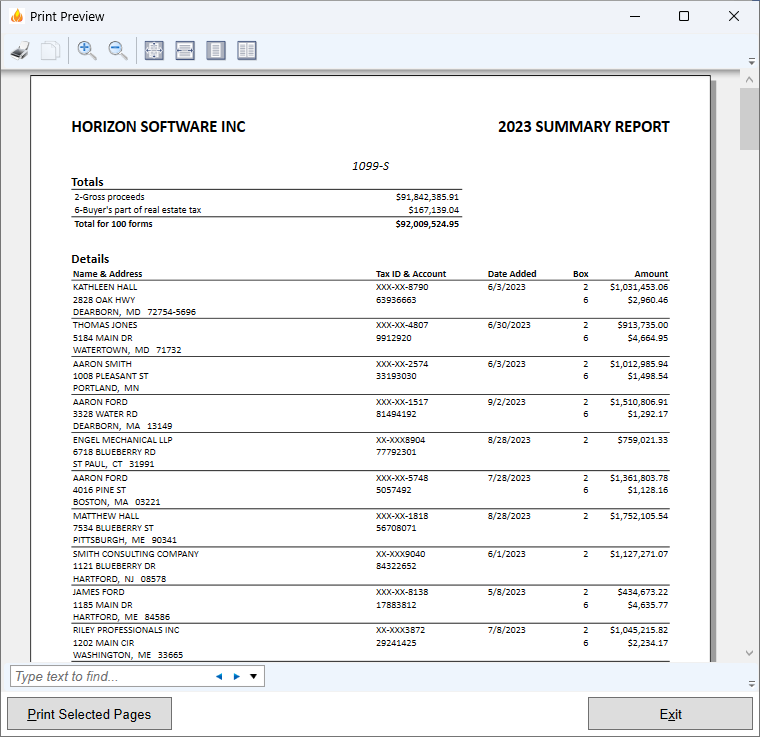

Improved Reports, Now Viewable All reports can be viewed in a Print Preview Window: |

|

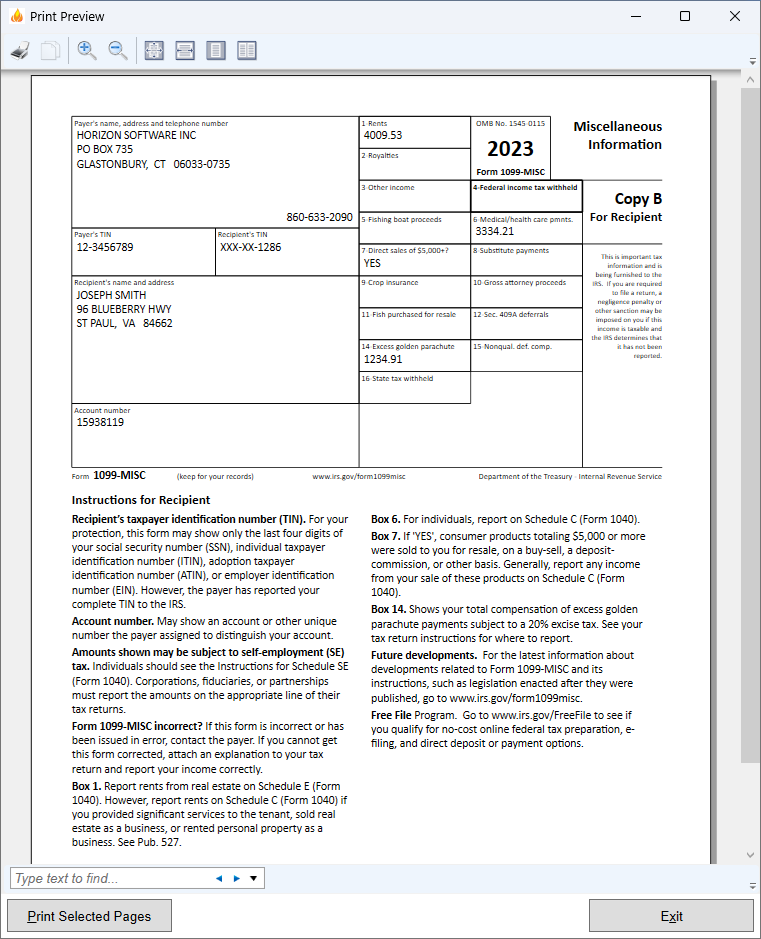

Redesigned Substitute Forms Our new substitute forms more closely resemble their official IRS counterparts. Instructions are listed at the bottom of the page, and only describe the boxes that are actually used on each individual form. |

|

Improved Transmittal Screen Any errors or warnings are displayed right on the transmittal screen, along with form counts for every type of form you have entered. All errors must be resolved before you can create your file for IRS. And a log of all transmittals is kept for your records. |

|